The Moneybox Business Saver is currently closed to new customers.

A great business savings account can help you grow your company’s cash. But with so many options, how do you pick the right one? Here’s a breakdown to help you decide.

Who needs a business savings account?

If you’re a business owner, a business savings account could play a crucial part in managing your business’ finances. Unlike a current account, a savings account is designed to help your business’ money grow. It’s the perfect home for:

- Emergency fundsFunds, also called ‘tracker funds’, are financial instruments that have been set up to match or ‘track’ the price of a market index. Investing in a fund lets you get exposure to different financial assets like shares and bonds, without having to buy them directly. to cover unexpected costs.

- Tax savings so you’re not scrambling when it’s time to file.

- Future investments for things like new equipment or marketing budget.

- Profit reserves that you’re holding onto for a rainy day.

Why let your business’ money sit idle when it could be growing?

Business savings vs. current account

The main difference between these two accounts comes down to functionality and purpose.

Business current account

- Purpose: day-to-day transactions.

- Use it for: frequent deposits, withdrawals, and payments. Think of paying suppliers, receiving payments from customers, and handling payroll. It’s all about keeping your business running smoothly.

- Interest: typically offers little to no interest on your balance.

Business savings account

- Purpose: growing your money.

- Use it for: holding cash reserves that aren’t intended for the day-to-day. These accounts usually have a higher interest rate, allowing you to earn money on your business’ cash.

- Interest: usually offer interest interest on your business’ savings, helping your cash reserves grow over time. However, it’s worth doing your research as some accounts offer more competitive rates than others.

You can have both! Many businesses use a current account for their daily operations and a savings account to store their profit or emergency funds.

How to choose the right business savings account

Choosing the right account depends on your business’ specific needs. Here are a few key things to look at:

- Interest rate: this is the most important factor. A higher rate means your money could grow faster than if it was sat in a no-or-low interest account.

- Access: how quickly do you need to access your cash?

- Easy-access accounts let you withdraw money whenever you need it.

- Notice accounts require you to give notice (e.g., 30, 60, or 90 days) before you can withdraw. They sometimes offer a higher interest rate in exchange for this restriction.

- Fixed-term accounts lock your money away for a set period, like one or two years. These accounts sometimes have the highest interest rates but offer no access to your funds until the term ends.

- FSCS Protection: make sure your money is protected. In the UK, the Financial Services Compensation Scheme (FSCS) protects up to £120,000 of your money per financial institution if the bank were to fail. Always check if the account you’re considering has this protection.

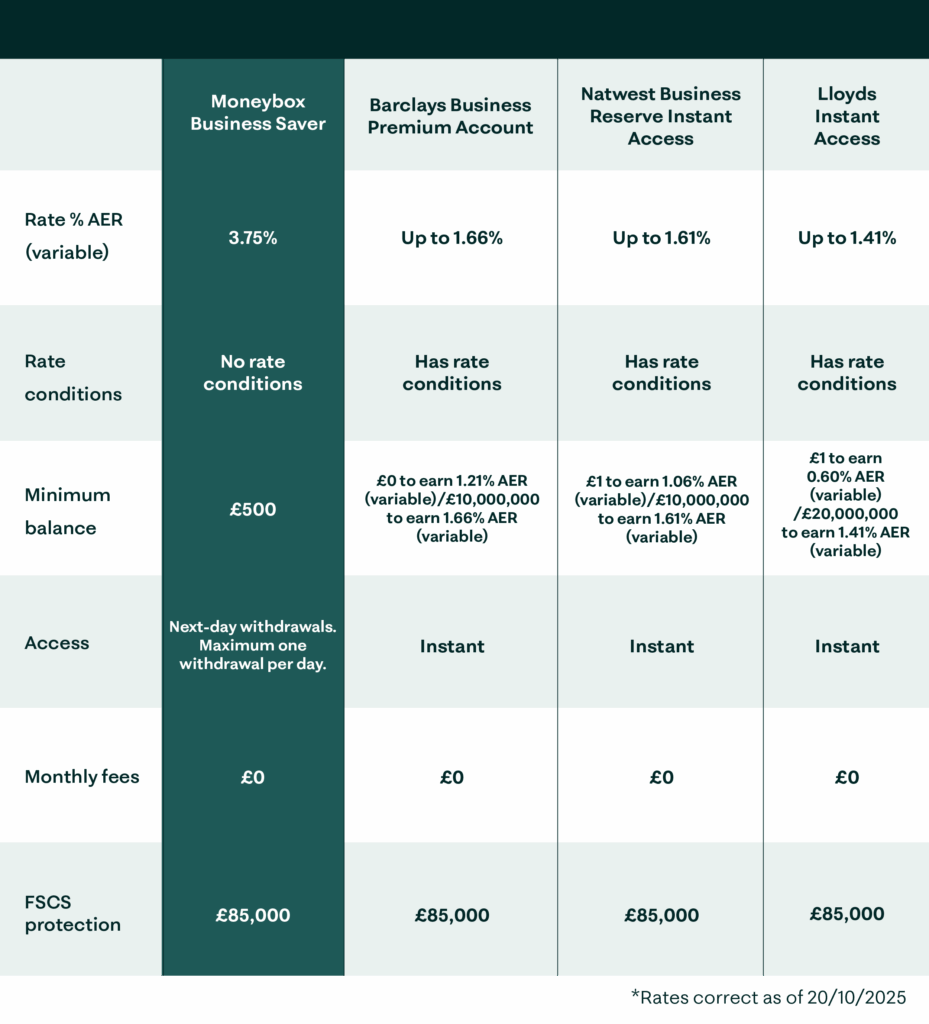

Moneybox Business Saver vs high street banks

Earn 3.75% AER (variable) on your business’ cash, restriction-free

A business saver should make managing your business’ finances easier, not harder. Grow your business’ money with 3.75% AER (variable) on as little as £500 with a Moneybox Business Saver. No complicated tiered interest rates, no fees, no stress. And you don’t need to be an existing Moneybox customer.

Apply for a Business Saver in minutes with Moneybox. Download the app or log in online to sign up and answer a few simple questions to apply.