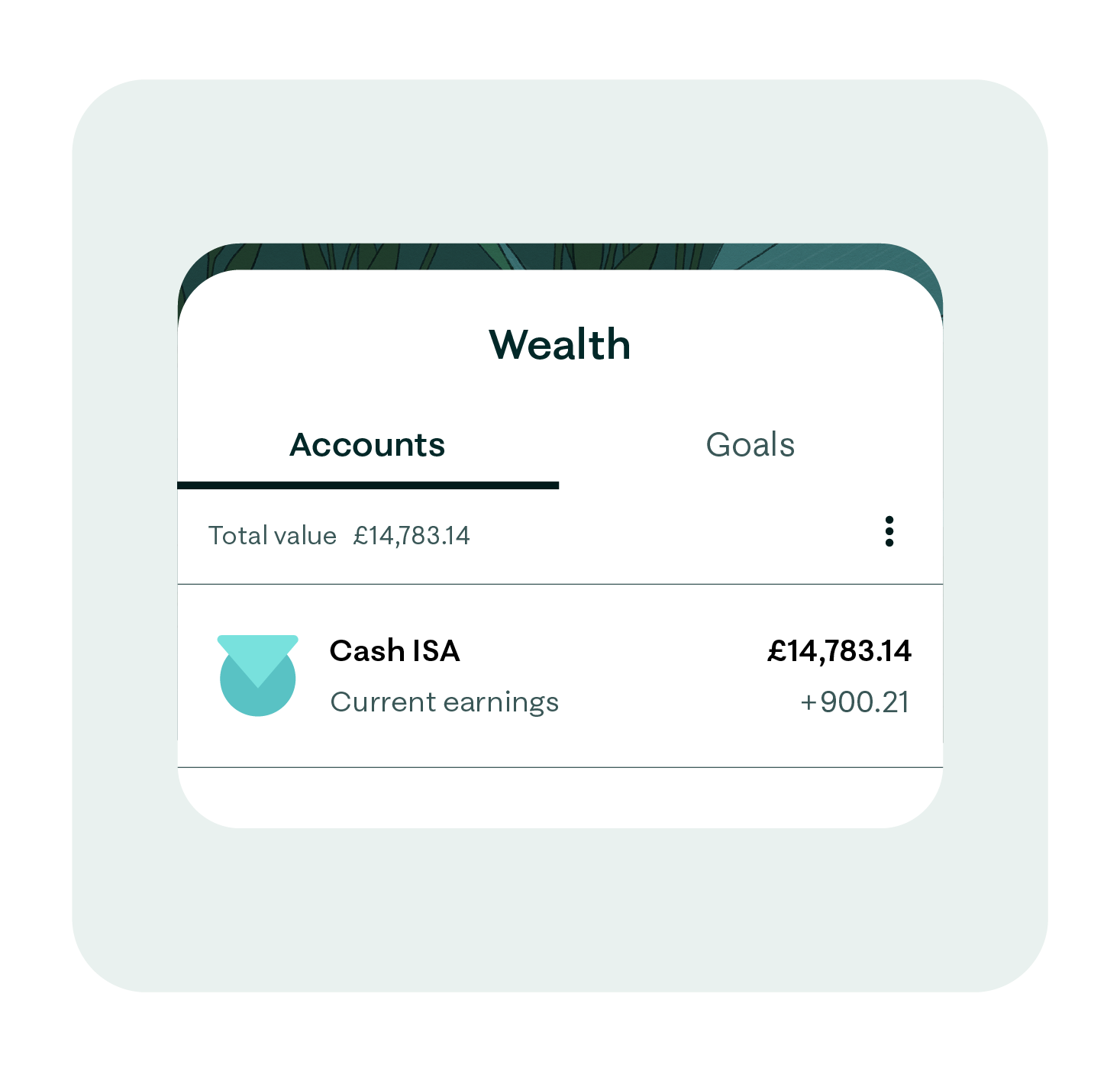

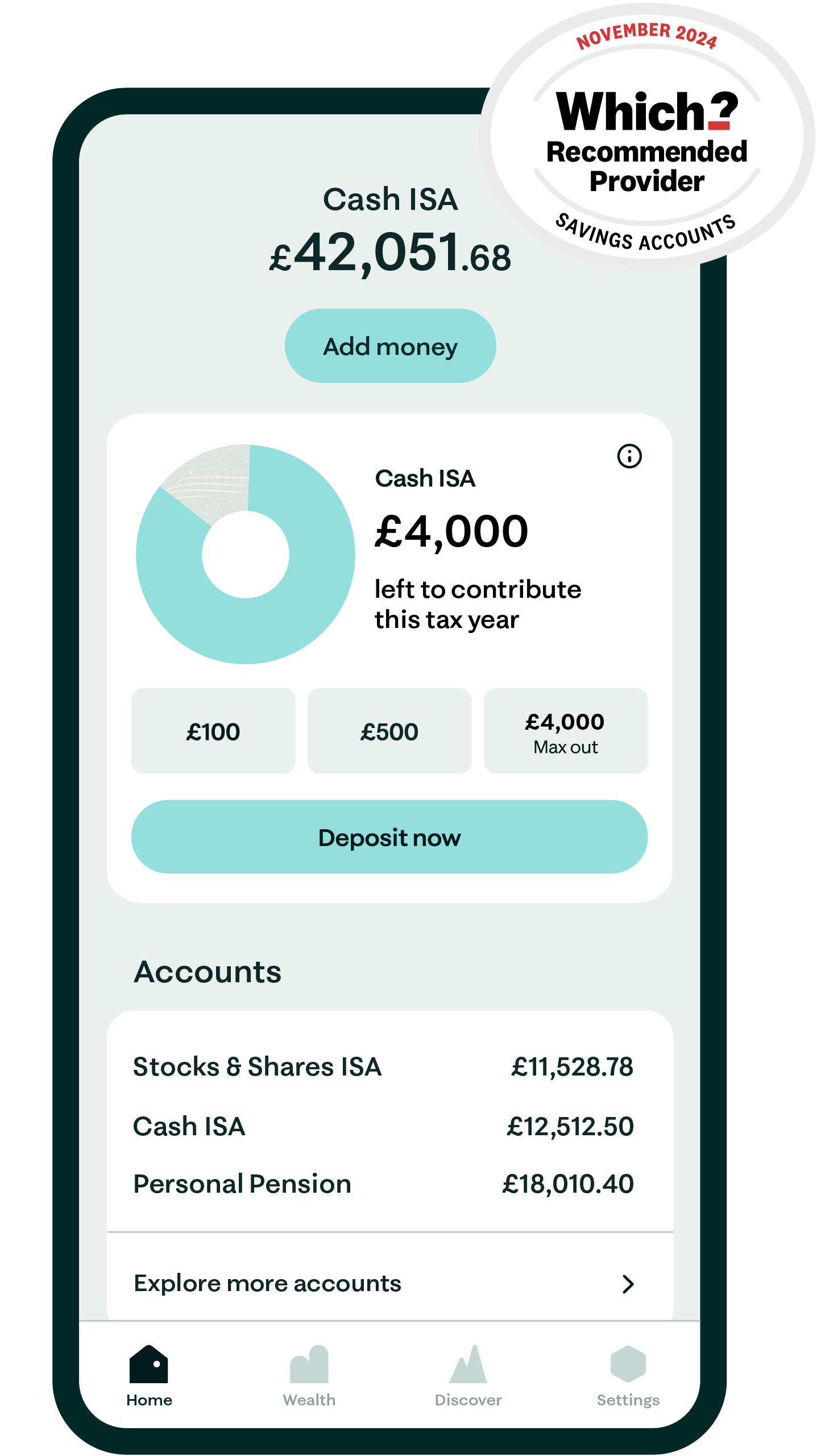

Earn 4.80%* AER (variable) with the Moneybox Cash ISA

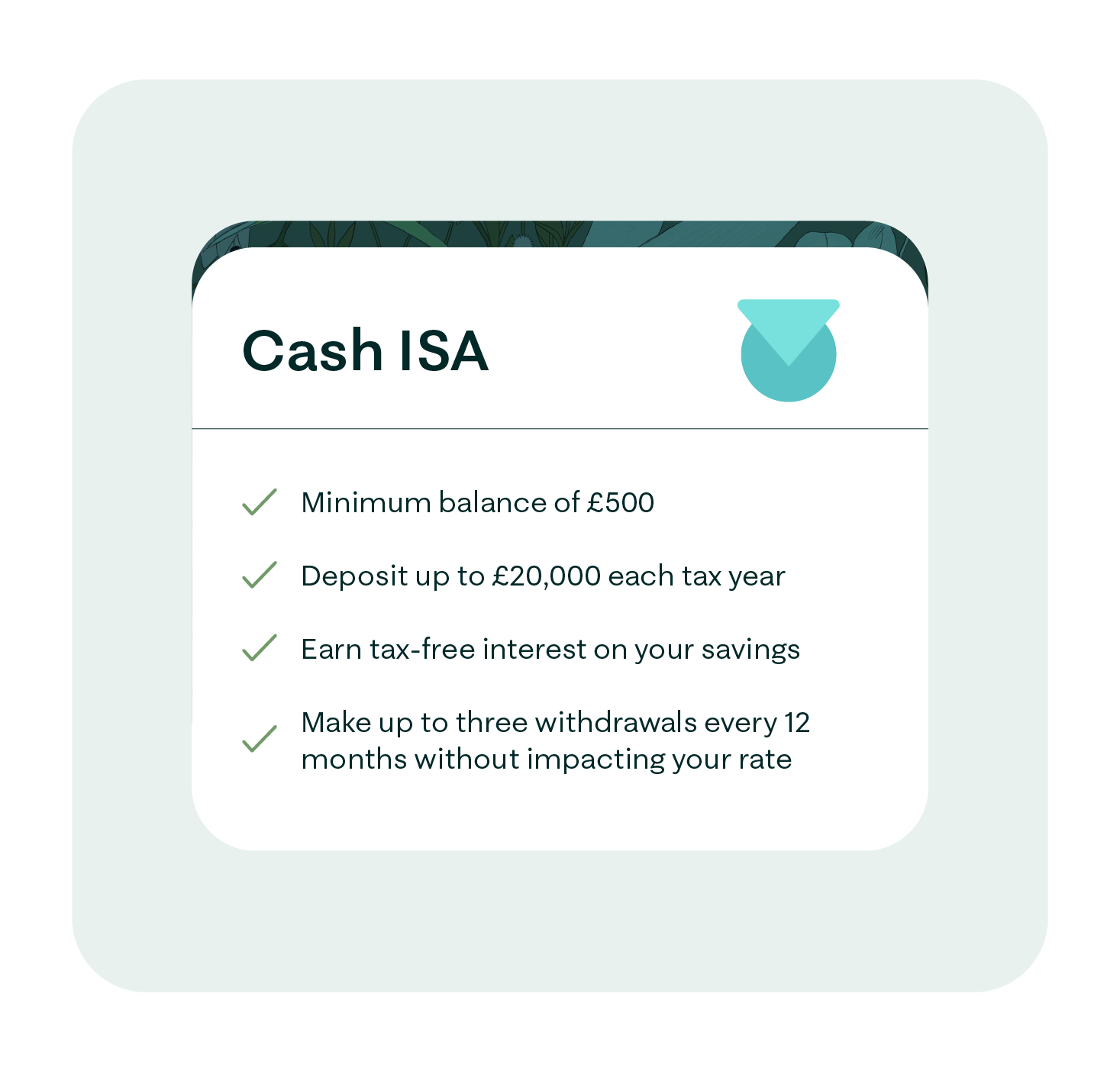

- Market-leading** rate for transfers in

- Save £20,000 a year with tax-free interest

- Open with £500

- Up to 3 withdrawals every 12 months without impacting your rate

Open or transfer an account in minutes and join over one million people saving with Moneybox.

Tax treatment depends on individual circumstances and may be subject to change in the future. *New customer rate as of 25/07/2025. Subject to conditions, includes bonus rate of 0.85% for first 12 months. **Moneyfactscompare.co.uk Top easy access cash ISAs.

Get started

Protected

Protected

Protected by the Financial Services Compensation Scheme. Learn more

Secure

Secure

We use bank-level encryption for all your personal information

Trusted

Trusted

Our customers rate us 'Excellent' on TrustPilot